Hi! Welcome to my blog 👋 This post is a part of the Edtech section of my blog, where I capture Edtech trends and insights in Vietnam and abroad.

Last weekend, I had the opportunity to attend an event hosted by Edtech Agency “White Paper and Ranking of Vietnam’s Edtech 2023”.

In this post, I will go over some of the key insights and learnings I gathered from the event.

You will learn about:

Global Edtech Market

Key Trends in Edtech in Asia

Notable companies and Key trends in Edtech in Vietnam

Let’s dive in!

I. Global Edtech Market

Global Edtech Market Down

The flow of venture funding to EdTech startups slowed noticeably in 2022 and the trend is extending into 2023. Crunchbase is reporting that 2023 has not yet seen a single funding round of US$100 million+, whereas there were more than 60 such investments globally over 2021 and 2022.

Big Edtech players such as Coursera, Kahoot, and 2U experienced a decline in revenues, resulting in a 49% decrease in market valuation compared to 2021 (Dealroom, as cited in Edtech Agency’s Whitepaper).

The decline likely results from the fact that 2020-2021 witnessed a record growth period in the history of Edtech due to an unexpected surge in online learning demand. Whereas entering 2022 and 2023, the world has started transitioning back to normal and Edtech needs to start finding its place in the normal world.

I would predict that 2023 is a rather dormant stage of Edtech. In 2023, instead of having large amounts of funding pouring into Edtech, we have been seeing smaller, early-stage funding rounds. Furthermore, the rise of AI in Edtech starting in March of this year certainly needs time for this industry to take off again.

Global Edtech Market Share

While North America remains the dominant player in the Edtech market with a total value of around $150 billion, the Asia-Pacific region is said to experience the highest growth rate. India and China stand out as the two major contributors to the overall market value in the Edtech market in Asia.

Global Edtech Market Insights

HolonIQ classified the Edtech market into two big segments: horizontal segmentation (based on customer groups) and vertical segmentation (based on product functionality).

Some examples of each segmentation are:

Horizontal: Preschool education, General education, Higher education, Corporate & workforce training

Vertical: Test preparation and Tutoring, Platforms and Tools, Language Learning, Publishing

Over the past three years (2019 to 2022), the Edtech market has witnessed a surge in Learning Management Systems (LMS) and teaching resources for general education.

Test preparation and online tutoring products are more prominent in emerging or developing markets such as India, Eastern Europe, and Southeast Asia.

Meanwhile, the North American and Western European markets focus more on B2B and B2C Edtech products catering to businesses and working professionals.

The demand for upskilling and reskilling to enhance skills and facilitate career transitions is expected to increase globally.

Global Edtech Giants of 2022

As of March 2023, there have been 30 remarkable EdTech unicorns worldwide, collectively valued at an impressive 89 billion dollars (HolonIQ, 2023).

Retaining its leading position, BYJU'S, the renowned Indian online education company, boasts a staggering valuation of 22 billion USD.

Global Trends in Edtech

Below are the key trends in the global Edtech landscape according to Maria Spies, Co-CEO of HolonIQ.

Emerging Technologies: AI and AR/VR are promising technologies to help make learning more personalized, experiential, and scalable.

Increase in M&A: The trend of mergers and acquisitions (M&A) continues to develop significantly. This drives the need to reduce costs in acquiring new customers, and one of the most effective and efficient ways is through mergers and acquisitions to achieve economies of scale.

Tutoring and supplemental learning support will continue to be in demand. However, we will expect to see modifications to learning models, with more hybrid models and attention to learning outcomes.

Language learning is materially underestimated due to its very high offline fragmentation and strong recent digital growth. HolonIQ suggests a $115B+ market by 2025.

VR & Simulated training is on the rise.

15-25% more usage of AI in core education processes. AI adds a lot of value to learning processes, assessment & feedback, and administrative processes.

II. Key Trends in Edtech in Asia

Tutoring, test preparation, English language learning, and STEAM education are highly common in the EdTech product structure of typical regions such as East Asia (China, South Korea, Japan...) and Southeast Asia (Singapore, Indonesia, Vietnam, Thailand...), accounting for over 50% of the EdTech market, with a strong focus on the K-12 segment (HolonIQ, 2022).

Direct-to-customer (D2C) distribution is the most prevalent business model, with up to 3/4 of startups adopting this approach (HolonIQ, 2022). However, based on data from the past 3 years (2019-2022) and expert opinions, the B2B model is experiencing growth momentum and has significant room for development due to the increasing demand for Learning Management System (LMS) services from businesses and schools.

India > China: Due to the new regulations in China's education policy related to extra-curricular tutoring since 2021, India has become a leading player in Asia.

III. Edtech in Vietnam

Vietnam Edtech Trends Classified by Horizontals

Preschool Education (~5.8 million learners based on 2021-2022 data)

The early childhood education segment has been growing strong in recent years. This is a promising market with great potential with nearly 5 million learners.

The most common topics for this segment are Maths, English, STEAM, robotics, and programming.

The most common delivery methods for this segment are gamification, homeschooling, and 1:1 tutoring.

Notable companies: Alokiddy, Kids online, KiddiHub, KidsUp

General or K-12 Education (~18 million learners based on 2021-2022 data)

This is the largest market segment in Edtech in Vietnam, accounting for almost 67% of the state budget for education.

The most common products for this segment are LMS, exam preparation, tutoring, and language learning.

Notable companies: Hocmai, Moon.vn, VioEdu, Azota, Teky, VietJack.com.

A challenge in the general education segment is that both families and schools have a low willingness to pay for Edtech products and services; thus, both B2C and B2B models might be challenging, especially in a very crowded market.

Higher Education (~2 million learners based on 2021-2022 data)

Currently, there are 16 higher education institutions in Vietnam granting Bachelor’s degrees through 100% online training. There is also a blended learning model, which combines online and in-person learning, either for regular degrees from Vietnamese universities or in collaboration with foreign universities.

There are opportunities for Edtech products to establish partnerships between Vietnamese universities and foreign universities to explore online or hybrid programs. Edtech products might also want to explore micro-credentials or vocational training programs to fulfill on-demand skills.

Notable companies: Unisoft, Topica, FUNiX

Corporate Training

The corporate training market is receiving increasing attention as recruitment and employee retention costs continue to rise, prompting businesses to focus on providing vocational training and upgrading skills for their employees to meet job demands.

The most common products for this segment are:

Platform providers: VietEd, Amber Online Education

Course providers: Agile Academy, PACE, Edtexco

Training for Working Professionals

The trend of upskilling or reskilling is considered an essential path for adult education, towards a lifelong learning model.

The most common products for this segment are programming, Business English, and data skills.

Notable companies: Unica, Edumall, Got It

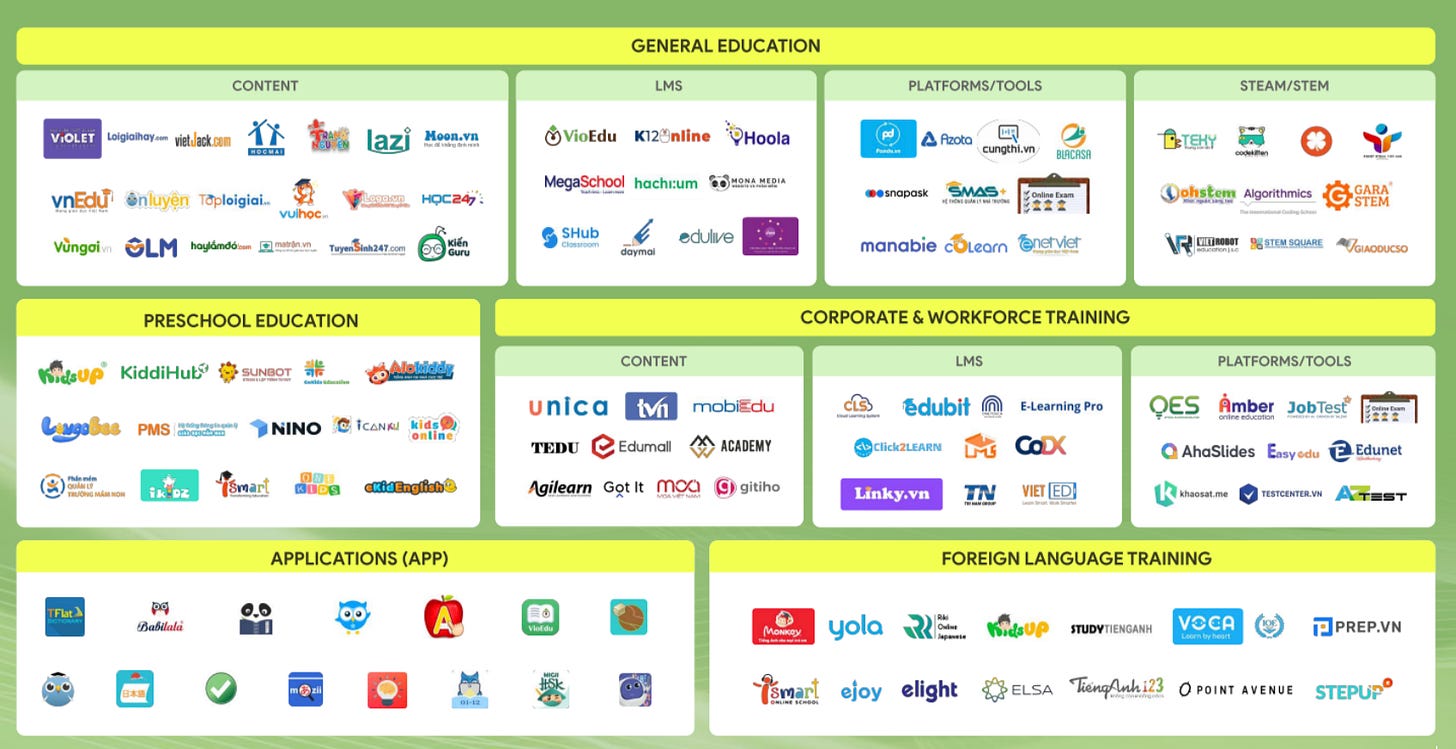

Vietnam 2023 Edtech Ranking Map

Overall Vietnam Edtech Market Trends

According to Statista, the revenue of the online education market in Vietnam is expected to grow at a rate of 10.4% per year during the period 2023-2027, reaching US$487.60 million by 2027.

The average revenue per user is estimated to be around US$43.25 in 2023 (source: Statista, as cited in Whitepaper).

B2C customer segments with higher affordability are likely to receive more attention and have good growth potential. These segments likely include early childhood education, upskilling/reskilling, and study abroad consultancy. Higher affordability might result from a rapidly growing middle class.

In the K-12 segment, different models of online tutoring and online classes are likely to be born as the Internet and technology infrastructure allows teachers and trainers easier access to teaching online. And as online classes become more widely available, people will look for solutions with the highest transformations. The way the online courses are delivered will matter a lot more.

Regarding technology, Vietnam will likely experience the adoption of AI in learning and teaching at a slower rate as compared to Singapore and Indonesia in the region. However, since Vietnam is a growing market, it’s likely that companies from Singapore, Indonesia, and South Korea will expand and increase investment in AI for learning in Vietnam.

If you want to read the full whitepaper, you can access it for free here.

Have a good week ahead ❤️

Our Writing On The Net course, a cohort-based course on blogging with 2 creators Akwaaba Tùng and Tuấn Mon, waitlist link is out here! Check it out and let me know if you are interested:)

You should write about the discrimination too